Other Services

- View All Services

- SaronMall

- Saron Service

- Realty

Get our mobile app

Enjoy a better shopping experience with exclusive deals and faster checkout!

Recommended Services

We provide other services also explore now!

SaronMall

A modern shopping destination offering fashion, food, and family fun all under one roof.

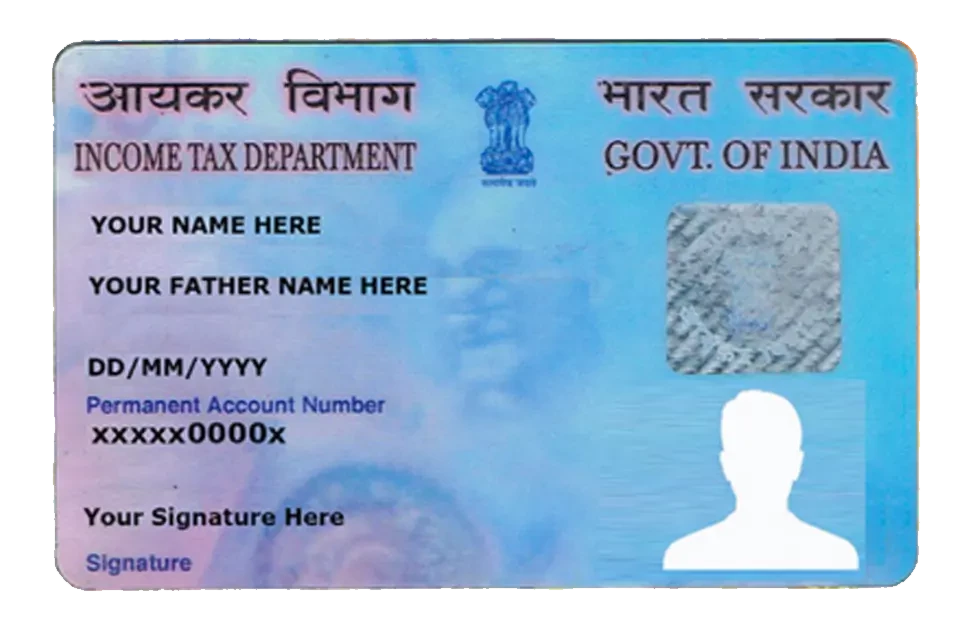

Saron Service

Reliable and professional maintenance and repair solutions for your everyday needs.